How to Recover Your Money from a Cyber Crime Scam: Step-by-Step Guide

According to the Federal Trade Commission (FTC), millions of people fall victim to cybercrime scams annually, costing them billions of dollars. Think about going to your bank one day only to discover all your money is gone, or getting an alert that you just spent thousands of dollars on something you did not. However, for many people throughout the world, this is not a nightmare but a daily reality – millions of people annually become sick.

And with the advancement of technology especially the ever-rising use of the internet, computer crime is on the rise. The scammers are slowly coming up with better tactics that often make the targets outsmart themselves. Although many of us already know the risks of phishing emails and fake investment invitations, there is always something new from fake invoices and ransomware to identity theft.

But there’s good news: taking swift action can significantly improve your chances of recovering lost money. Also, valuable tools like a VPN (Virtual Private Network) help shield our information and minimize our risk of exposure to such tricks at that initial stage. This guide will take you through the practical steps to take to reclaim your money and prevent yourself from being a victim of any form of cybercrime scams.

Understand the Types of Cyber Scams

When you want to recover your lost money after being duped online, you need to know the various kinds of cybercrime scams to avoid falling victim repetitively. In this way, cybercriminals use a set of strategies that will either find vulnerabilities in the security or take advantage of human failure to entice individuals to ‘donate’ personal or financial data. Here are some of the most common types of cyber scams:

1. Phishing Scams

- What it is: Phishing scams are one of the most well-known and deceitful types of fraud; it includes sending fake messages that come under the mask of well-known institutions of a certain country including banks or any other organizations which offer some services online for example sending an e-mail or message which asks the recipient to type in his/her password, account or credit card number.

- Real-life case: One of the examples of such scams was carried out in 2020, impersonating PayPal, Netflix and other notable companies, emitting phishing emails to update payment data, and scoring the stolen credit card data in hundreds of thousands.

- Consequences: People become locked out of their accounts, get accounts emptied, or have their identity stolen. Some of the problems caused by invasion of privacy include: Organisation can experience recovery hitches when the information is employed directly in making big purchases.

2. Ransomware Attacks

- What it is: Ransomware will either lock your computer screen or encrypt your data and will only release control once you have paid the ransom. There is an aspect in which criminals make their demands more anonymous for a similar purpose, to get paid in cryptocurrency.

- Real-life case: The most notorious attack of this year was the hack on the US Colonial Pipeline that stopped a significant source of fuel in the country, in exchange for millions of dollars worth of Bitcoin. The company complied with the demand and paid the ransom alongside suffering tremendous losses, and disruptions.

- Consequences: They get pressurized to pay a large amount of ransom and even if they manage to seem the money there is no guarantee that the data it be recovered. At times, files may be totally overwritten and this leads to loss of great amount of money.

3. Identity Theft

- What it is: Identity theft is also common and happens whereby an individual surreptitiously acquires your social security number or credit card information or user name/password and impersonates you to open accounts in your name in an attempt to embezzle funds.

- Real-life case: One of the most highlighted happened in 2017 when Equifax protracted database unveiled private information such as credit card numbers, social security cataclysm, and names of more than 147 million individual. The common factor was that widespread identity theft emerged from this.

- Consequences: Consumers lose a lot of money and spend years pulling their credit scores back from the dregs and cleaning up the mess created by fraudsters.

4. Investment Fraud

- What it is: Fraudsters present themselves as brokers providing high payable and low risky investment options. In many of scams they will usually be Ponzi schemes or pump and dump schemes in cryptocurrency or stock markets.

- Real-life case: As much as investment fraud is prevalent, some high-profile fraudsters include; The Bernie madoff scheme which is a Ponzi scheme. A lot of intelligent investors were defrauded of billions of their hard earned money when the fraudulent scheme crumbled.

- Consequences: People can lose all their savings and as most money moves in a blink of an eye making the retrieval of this money almost impossible without engaging the services of a lawyer.

5. Tech Support Scams

- What it is: Two of these scams involve impersonating to be a tech support from a reputable company (Microsoft or Apple) to tell you that your computer has been infected by malware. They request access to your device remotely that is, and either steal your data or offer you unnecessary services with a price.

- Real-life case: serial fraudsters who defrauded thousands of people out of more than $100m by posing as a tech support services provider were arrested by the FBI in a crackdown in April 2019.

- Consequences: Money thefts are common since victims pay through fake accounts, and scammers get access to personal information on the target’s devices.

Consequences of Cyber Scams

The consequences of falling victim to any cyber scam can be devastating:

- Financial loss: Cyber criminals often withdraw all the balance of your account, buy items online on your behalf, or even start requesting for large sums of monies.

- Emotional toll: They develop embarrassment, stress or fear concerning the safety of their information as victims.

- Legal implications: Likely legal consequences that people when they fall victims to identity theft are handling of fake debts and loans that may have been opened under the victims’ identity.

Every type of scam needs a specific way to get your money back that is why we need to identify what kind of scam it is as soon as possible.

Chart/Table Idea: Comparison of Scam Types and Recovery Strategies

Different types of scams and the appropriate recovery strategies for each. Below is a suggested layout for a chart or table:

| Scam Type | Description | Common Signs | Immediate Recovery Steps | Long-Term Prevention Strategies |

|---|---|---|---|---|

| Phishing | Fraudulent emails or messages tricking individuals into providing personal information. | Unusual requests for information, misspelled emails, and suspicious links. | – Report to FTC and IC3 – Change passwords immediately – Notify your bank if sensitive info was given. | – Use a VPN – Enable MFA – Regularly update passwords. |

| Identity Theft | Someone steals your personal information to commit fraud. | Unauthorized transactions, unfamiliar accounts opened in your name. | – Place a fraud alert on your credit report – Report to the FTC – Contact banks and creditors. | – Monitor your credit report regularly – Use identity theft protection services. |

| Investment Fraud | Scams that promise high returns with little risk, often involving Ponzi schemes. | High-pressure sales tactics, promises of guaranteed returns. | – Report to the SEC or CFTC – Consult with a financial advisor. | – Research investments thoroughly – Be wary of “too good to be true” offers. |

| Ransomware | Malware that locks your files or device, demanding payment for access. | Inability to access files, ransom note displayed on your device. | – Disconnect from the internet – Report to law enforcement – Restore from backups if available. | – Regularly back up files – Use reputable antivirus software. |

| Romance Scams | Fraudsters build emotional relationships to solicit money or personal information. | Rapidly escalating emotional connection, requests for money. | – Stop all communication – Report to the FBI’s Internet Crime Complaint Center. | – Be cautious about sharing personal information online – Verify identities through video calls. |

Immediate Steps to Take After a Scam

It is, therefore, important that, should you have fallen for a cybercrime scam, the earlier you act, the less impact the crime will have and the more likely you are to be able to get your money back. Here are the immediate steps you should take:

1. Contact Your Bank/Financial Institution

The first thing which a person should do when he understands that he became a victim of a scam is to call his bank or credit card company right away. The faster one passes this information to the banking authorities, the better the chances the banking authorities get to freeze the further wrong transactions.

Steps to Take:

- Freeze Your Accounts:

- Ask your bank to block all transactions from your account for some time. This will prevent formation of any new unauthorized charges while you and your bank traces the situation.

- Then, if your credit card information has been stolen, tell the bank to freeze your card and have you issue a new one.

- Reverse Unauthorized Transactions:

- If a scammer has charged your card, kindly ask the bank to perform a chargeback or the transaction can be disputed.

- For debit card or a bank account, fraud, some institutions can reverse the unauthorized transactions If reported early enough.

- Close Compromised Accounts:

- If the particular scam has caused serious violations, it may be logical to shut the injured account and generate a new one to avoid additional problems.

Examples of Bank Fraud Protection Programs:

- Bank of America offers a $0 Liability Guarantee, which means you won’t be held responsible for fraudulent transactions if they’re reported within a timely manner.

- Chase Bank provides 24/7 Fraud Monitoring and text/email alerts when unusual activity is detected, allowing you to act quickly.

- Wells Fargo has a fraud protection service that automatically monitors for suspicious transactions and provides quick assistance to dispute unauthorized charges.

These programs are intended for your protection but they only work if you report fraud the moment it is noticed. It is always important to monitor your bank statements frequently more so after being scammed.

2. Report the Scam to Authorities

After you have dealt with your bank accounts the next thing you need to do is to report the scam to the relevant authorities. The mamma also reveals itself as a tool to help the victim himself track down the scammer and make sure they do not elude justice and fall for other people.

Authorities to Report to:

- Federal Trade Commission (FTC):

- The FTC handles consumer complaints related to online fraud and scams. You can file a complaint online through the FTC Complaint Assistant:

https://reportfraud.ftc.gov/ - The FTC may investigate your case and provide guidance on next steps. While they don’t recover funds directly, reporting helps them build cases against repeat offenders.

- The FTC handles consumer complaints related to online fraud and scams. You can file a complaint online through the FTC Complaint Assistant:

- FBI’s Internet Crime Complaint Center (IC3):

- The IC3 is the primary agency for reporting internet-based crimes in the U.S. If you’ve fallen victim to an online scam, you can report it to the IC3 here:

https://www.ic3.gov/ - Include as many specific and particular details as you possibly can; figures, photographic evidence and even receipts of the conversations the scammer and yourself had. The FBI relies on these reports in order to monitor rhythms and in the orchestration of the operations of recovery.

- The IC3 is the primary agency for reporting internet-based crimes in the U.S. If you’ve fallen victim to an online scam, you can report it to the IC3 here:

- Local Law Enforcement:

- Aside from federal offices, you should also report to the police and the local authorities if there is any. Almost all the banks and the credit card companies would demand this where there is an intent of undertaking major financial recovery processes.

- Other sources of advice are cybercrime units within one’s local police department.

- Consumer Financial Protection Bureau (CFPB):

- If you’ve been the victim of a financial scam, especially one involving deceptive financial products, you can file a complaint with the CFPB:

https://www.consumerfinance.gov/complaint/ - The CFPB can mediate with financial institutions on your behalf and assist with recovering funds.

- If you’ve been the victim of a financial scam, especially one involving deceptive financial products, you can file a complaint with the CFPB:

When to Involve Legal Authorities:

If the given scam implies a million of dollars or identity theft presenting the information to legal power agents become mandatory. It’s a good idea to write a police report or seek advice from a cybercrime lawyer if you want to go to court to try and get your money back. A detailed report will also help to stop this person from hustling others.

Relevant Links for Reporting Cybercrime:

- FTC Fraud Reporting: https://reportfraud.ftc.gov/

- FBI Internet Crime Complaint Center (IC3): https://www.ic3.gov/

- CFPB Complaint Portal: https://www.consumerfinance.gov/complaint/

- Local Law Enforcement Directory: Use online tools to find your local police cybercrime division or consult your city’s website.

When you communicate with your banks/credit card providers as well as reporting the fraud to the right authorities, you set yourself and your finances on the right recovery track. The sooner you perform these steps, the more likely you’ll reduce your losses and catch the scammer.

Legal Options for Recovering Lost Money

However, if all the first and elementary actions like notifying your bank and the authorities and not getting your money back, then it might be time to go to court. Those who fall victims and lose their money or become victims of more severe scams need to seek help from a lawyer who deals with cybercrimes or opt for a chargeback from the credit card firm.

1. Hiring a Lawyer Specialized in Cyber Crime

An experienced cybercrime lawyer can be quite useful in assisting you to reclaim lost money as is the case with large amounts of cash and if the scam involves parts of the world you understand little about. This is because cyber criminals are adept at how they work and those in the legal sector that specialize in cyber crime know who to involve in policing or financial institutions when following the money.

How Cybercrime Lawyers Can Help:

- Trace Stolen Funds:

- While searching for the origin of the stolen funds, cybercrime lawyers quite often work together with detectives or professionals in the field of digital forensics. This may involve tracking fake IP addresses, laundering money and accounts in Bitcoin or any other form of cryptocurrency.

- For instance, in crypto currency scams, lawyers can use blockchain to investigate where the money has been transferred or exchanged to.

- File Civil Lawsuits:

- If the scammer is found, then one takes help of a cybercrime lawyer to report the crime and fight a civil trial lawsuit for compensation. In situations where the loss has been a large sum of money, this may well be the best legal course.

- Negotiate with Financial Institutions:

- While most cybercrime attorneys cannot directly negotiate with banks and credit card companies, they have enough legal knowledge to ensure you get your money back, a chargeback or even settlement.

- Coordinate with Law Enforcement:

- Cybercrime attorneys can closely cooperate with the police to solve such cases, and help to regain the stolen amounts more quickly if such jurisdictions are open online.

Key Points to Consider When Hiring a Cybercrime Lawyer:

- Experience: Ensure that the lawyer you hire specializes in dealing with computer crime especially and particularly the financial fraud. You should try and see more of the cases that practicing lawyers deal with so that you be able to determine if the are qualified enough to handle your case.

- Cost: The challenge is that cybercrime lawyers can be costly; thus, there is a need to look at potential recovery vis-a-vis the cost of hiring the lawyer. In one case they might charge for a retainer fee but others may allow them to be paid through a contingency fee that involves paying them a certain percentage of the recovered amount.

- Resources and Connections: Seek if the lawyer has some knowledge, or acquaintance with forensic or policemen that may be useful in tracking funds across borders.

- Reputation: Any reputable attorney should not have any complaints against them, and to double check, you need to check on reviews for the attorney from other clients, past disciplinary actions or any complaints that were filed against that attorney.

Example of Cybercrime Legal Help:

In 2019, the large scale BEC scam involving money from a New York based law firm was successfully resolved where by the law firm recovered millions of dollars with the assistance of the bank, regulators and international authorities in the tracing and freezing of the money.

2. Chargebacks and Disputes

In the cases of credit card fraud or specific bank transfers, it is possible to try to return the stolen money through chargeback. A chargeback is conducive to regimes to enable customers to fight for their rights against facilitators of unauthorized and fraudulent charges while likely to have the merchant or the scammer conduct the investigation.

How to Request a Chargeback from Your Credit Card Provider:

- Contact Your Credit Card Provider:

- The next time you hear anything that makes you suspect that you were scammed, call your credit card provider immediately to block the fraudulent transaction.

- Majority of credit card firms have a fraud department that will assist you in initiating a chargeback.

- Provide Documentation:

- You will be required to provide proof that the transaction was a scam such as; receipts, emails or instant messages with the scammer amongst others. Be as detailed as possible.

- Some providers may require a police report, or a report from the FTC or IC3 to help support your complaint.

- Follow Up Regularly:

- Maintain a diary of the conversation that you carry out with the bank of the credit card provider and frequently follow up on the progress of your chargeback.

What to Expect During the Dispute Process:

- Investigation Timeline:

- The credit card provider will initiate an investigation, and this can take anywhere from 30 to 90 days, depending on the complexity of the case.

- As mentioned earlier, where the scammer is not forthcoming, or where there is evidence of a scam, the chargeback is often likely to be approved quickly.

- Temporary Credit:

- While Some of the banks or credit card companies may give you a temporary credit while they investigate the charge. This objective assures that you are not made financially compensate for any losses when the disagreement is still underway.

- Outcomes:

- If the bank favours them, the amount in dispute will be credited back to your account perpetually.

- However, if it is denied (for example where the scam might be difficult to explain or prove to the seller), you will need to either call a lawyer or reopen the case with more proof.

Chargeback Limitations:

- Time Limits: Most credit card companies have timeframes within which chargeback requests must be made and these stand at 60 to 120 days after the transaction. Make sure to act quickly.

- Non-Credit Payments: With chargeback, customers can only claim back their money from a credit card merchant. Having deposited money using a debit card or wire transfer or, even in some cases, using bitcoins, you may not be able to recover your money through a chargeback, and your only available action will be to take the online casino to court.

This means that if you decide to go to a higher authority by engaging the services of a cybercrime lawyer or filing for a chargeback dispute you stand a better chance of recovering your lost cash to a scam. What is important to know is that in the legal processes time can work against you; however, if one acts fast and collects concrete evidence one will most certainly benefit from it.

Using Technology to Track and Recover Funds

In the current world of technology, technology is both a weapon against cybercrime and a tool for remediation of it. In both cases, the right cybersecurity tools could make a great deal of difference if used in the right manner. This section will bring up various technologies such as VPNs, blockchain analysis and many other tools which can help in money recovery and protecting your behaviour online.

1. Introduction to Cybersecurity Tools

Software applications protect a person’s information on the internet and check suspicious activities that may be useful in the evasion of fraud as well as retrieval of lost funds. Here’s a breakdown of some key tools:

- Anti-Malware Software: These tools look for viruses, worms, Trojan horses, spyware and other nasty things that scammers might use to pilfer your details. To avoid further losses it is crucial thus to ensure your devices are not infected with malware.

- Two-Factor Authentication (2FA): By implementing 2FA all of your accounts will have an extra shield so that even if the criminal gets your password he won’t be able to get into your accounts.

- Password Managers: A password manager is used to properly create a long and complicated password for each of your accounts, so there is no risk of password theft through phishing or data loss.

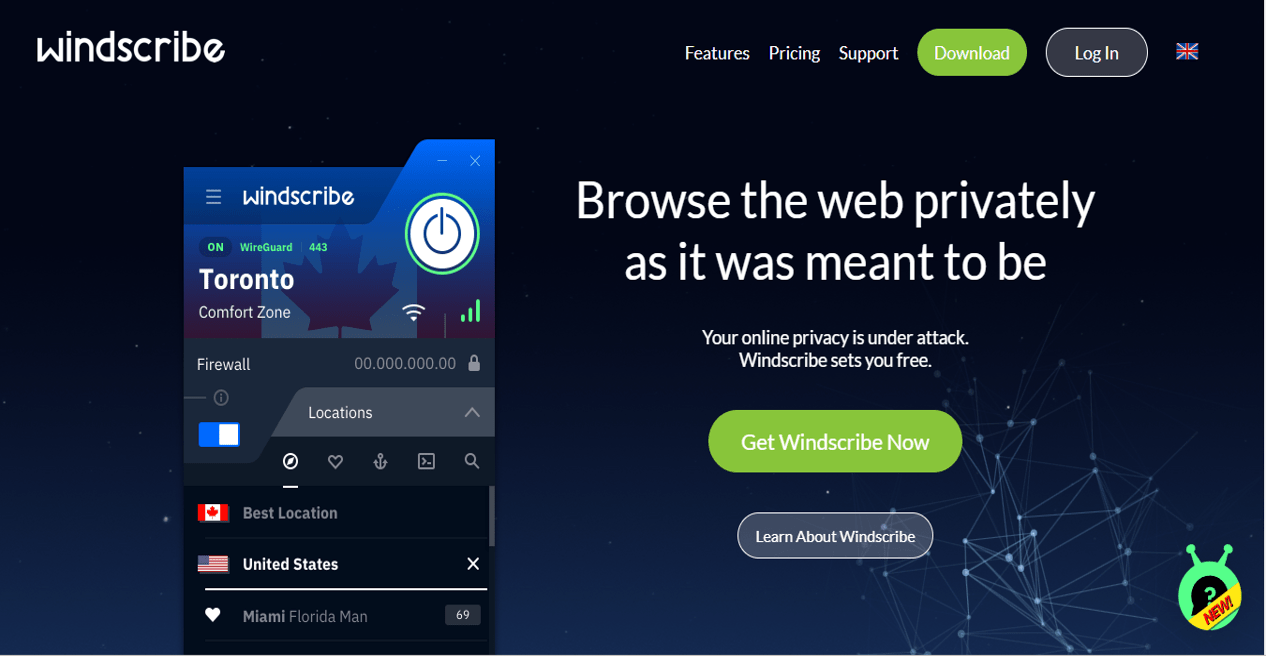

2. VPNs as a Tool to Prevent Future Scams

A Virtual Private Network (VPN) is perhaps one of the most effective tools that can be used in fighting future scams. A VPN shields your data by encrypting it when it is on the internet and concealing your IP address such that it cannot easily be located by hackers.

How VPNs Work:

- Encryption: VPNs encrypt your connection so your device directly communicates with the internet. This encryption means that any information that is being transferred can only be done in a safe manner away from the reach of hackers.

- Anonymity: VPNs also do not allow hackers to follow your online activity or even gauge your location through your IP number. This helps in turning down your probability of being on the receiving end of phishing or frauds.

Benefits of Using a VPN:

- Secure Online Transactions: Regardless of whether you are conducting an online banking transaction or shopping, a VPN puts a layer of security on the transaction, which is not easily penetrable by malicious individuals out to steal your money.

- Avoiding Malicious Websites: Some VPNs even have a malware and phishing protection system, which alerts you of potentially unsafe sites of,你 or scams links before you even get to click on them.

- Public Wi-Fi Protection: Public wireless networks are usually critically insecure. VPNs prevent your information from being discussed with the public, even if you are using poorly secured networks like Wi-Fi.

Choosing the Right VPN:

- Look for a VPN provider that offers strong encryption protocols (such as OpenVPN or WireGuard) and a no-logs policy to ensure your data remains private.

- A good VPN should also provide high-speed servers and be compatible with multiple devices, including smartphones and computers.

By using a VPN, you not only protect yourself from being targeted by scams, but you also prevent data breaches and identity theft, ensuring a safer online experience.

3. Blockchain Analysis in Cryptocurrency Scams

If you have been scammed and your bitcoins or other cryptocurrencies stolen, it can be quite difficult to get back your cash back because block chain technology is deemed decentralized and uses pseudonyms. But, in general, blockchain analysis is an excellent opportunity to track the funds and, possibly, restore them.

What is Blockchain Analysis?

- It is important to note that blockchain is actually a shared record of all transactions made using a certain crypto currency, be it Bitcoin, Ethereum, and others. Although the actual identities of the transacting counterparties are hidden, the underlying system maintaining the transactions is fully open for public vEWing.

- Thanks to the blockchain analysis platforms that are available to investigators, it is easy to follow the fund trail through this public ledger to determine the various destinations to which the stolen funds have been transferred, or if they have been traded for other cryptocurrencies or transferred to a central platform from where it will be easier to pull out the money.

How Blockchain Analysis Helps Recover Funds:

- Identifying Wallets: The characteristics of a blockchain may be useful in identifying wallet addresses belonging to the scam. While these addresses do not include personal information, most scammers transfer the money to centralized exchanges where they may possess an account with coefficients connected to personal data.

- Exchanges and Compliance: The additional advantage of exchanging stolen cryptocurrency to a compliant exchange that implements Know Your Customer (KYC) policy, is that the authorities can ask the exchange operator for details about the account holder thereby enhancing the chances of getting back the embezzled funds.

- Blockchain Forensic Tools: There are two industries based on blockchain technology, one of them is blockchain forensics, companies involved in it are Chainalysis and Elliptic. Through complex computation, they are able to track the movement of cryptocurrencies and give helpful information to the police in the fight against cybercrimes with recovery of lost items.

Limitations of Blockchain Analysis:

- Anonymity: However, the use of the blockchain analysis is useful but not 100% accurate. Some criminal, in an attempt to hide the source of fund, may actually engage in methods such as mixers or tumblers that pool several transactions. This can make it much harder though not impossible to track the stolen cryptocurrency.

- Jurisdiction Issues: Most cons are from countries with little or no legal redress so police cannot easily seize money or arrest the con artists.

Success Story Example:

This year, action with the use of blockchain analysis has led to the identification of the recipient of $2.3 million in Bitcoins that was paid as ransom for a cyberattack on Colonial Pipeline. Blockchain analysis enabled the FBI to find the trail of the funds and then freeze them in a wallet.

This is why by employing certain cybersecurity tools it is possible to both avoid similar scams in the future, as well as to perhaps regain some of the lost funds in online scams. These technologies are slowly evolving and readily available and enables the victims of cybercrime to fight and gain justice.

Steps to Prevent Future Scams

Any action to avoid further scams has to be taken, so that your personal and financial details remain protected. VPNs are great for changing your IP address, thus making it challenging to target you, and MFA adds a second layer of security whenever you’re offered an account that you can sign in to, and these methods, together with avoiding to click on links from strange senders, will allow you to minimize an opportunity to be ensnared in a trick.

1. Educate About VPN Usage for Online Privacy

One of the best security programs that you can use to improve your security online is a Virtual Private Network (VPN).

Why You Need a VPN:

- Encryption of Internet Traffic: VPNs provide a layer of security to your internet connection that it becomes very difficult for hackers to hack into them. This is especially important when one has to connect to the internet by use of Wi-Fi that is from a public place and which is most times not secured.

- Hide Your IP Address: A VPN conceals your IP address meaning that criminals cannot easily monitor what you are doing online, or even better, scam you.

How to Use a VPN Effectively:

- Always Enable Your VPN: It’s good practice to always have the VPN on whenever you are browsing the internet especially when entering your personal/financial details.

- Choose a Reliable VPN Provider: Be wary of VPN providers with high speeds and endpoint countries that do not provide powerful encryption packages and do not respect your privacy enough to not log you. Free VPN services should be avoided as much as possible because it is usually a means for your information to be stolen.

- Use on All Devices: Make sure that you have installed your VPN on all your devices, mobile, tablet, computer and others.

Tip: Many VPN services come with built-in features like ad-blockers, anti-phishing protection, and malware detection, which provide an extra layer of security.

2. Importance of Multi-Factor Authentication (MFA) and Strong Passwords

Implementing Multi-Factor Authentication (MFA) and using strong passwords are critical steps to secure your accounts and prevent unauthorized access.

Multi-Factor Authentication (MFA):

MFA enhances account security because alternatives to passwords are needed to gain access to your accounts. Typically, MFA requires:

- Something You Know: Your password.

- Something You Have: A code sent to your phone or generated by an authentication app.

- Something You Are: Biometric information like a fingerprint or facial recognition.

How MFA Protects You:

Should you have your password pilfered by a phishing attack or data breach, the second form of identification is impossible for the fraudster meaning they are highly unlikely to be hacked into.

Enabling MFA:

- Use MFA on all important accounts, for example, email, bank accounts, social networks, accounts where financial operations are performed.

- If it is not possible to go with an authentication app like Google Authenticator or Authy avoid to use the SMS based codes since SMS can sometimes be intercepted by the hackers.

3. Tips on Identifying Phishing Schemes

The most global attack that the scammers use to deceive people is known as phishing. It is very important to know how to distinguish the scam from other forms of malicious activity, if you want to be safe from such scams.

Common Signs of Phishing Attempts:

- Suspicious Email Addresses: Check the sender’s email address carefully. Scammers often use addresses that look similar to legitimate companies, but have subtle differences (e.g., using @paypa1.com instead of @paypal.com).

- Urgent or Scary Language: Most phishing emails have a click sense of urgency are said to be notifying you or confirming that they has messed up your account. Do not rely your identification on any email or message telling you a scary story about yourself.

- Unexpected Attachments or Links: Do not reply or forward any email from someone unknown or that you do not know the sender, never open any attachments in mail or click links in them. When you move the computer pointer over the link, a small box pops open and you can read the real address before the link is actually followed. If it sounds like that, do not respond to it or simply remove yourself.

What to Do If You Suspect a Phishing Attempt:

- Don’t Click: If you receive such an email feel that it is a phishing attempt do not attempt to click on any link or open any attachment. However, this can be done by accessing the website by directly entering the web address on the address bar of the browser or via a book marked link.

- Report Phishing: All most all primary Email client providers have some kind of option for reporting phishing emails. Bear in mind that reporting helps in preventing other scams.

- Verify Before Acting: If the email message was supposedly from a company, bank or service you are using, do not reply; instead call the firm, using the number provided on the official website.

Phishing Example:

A typical phishing strategy is to use the email from the name of your bank and request to update your profile. It is sent via email and directs the recipients to a website that is very similar to that of the bank. As soon as you put your login details, the scammers also get your details and access your account. Even if the mailer’s name and logo has been used, be very wary of opening emails that were not expected or requested.

Summary of Prevention Steps:

- Use a VPN to secure your internet connection and mask your online activities from cybercriminals.

- Enable MFA on all important accounts to prevent unauthorized access, even if your password is stolen.

- Use Strong Passwords that are unique and difficult to guess. A password manager can help generate and store these passwords securely.

- Be Aware of Phishing Schemes by recognizing the common signs of phishing attempts and knowing how to respond appropriately.

That way, you’ll be ready to steer clear from future cybercrime scams and reduce your vulnerability to any online dangers. That way, it becomes about doing it yourself, being informed, and utilizing the right applications to protect your digital identity.

Additional Resources and Support

The aftermath of a cybercrime scam is daunting, but it doesn’t have to be done alone. The favoured source of support with regards to cybercrime victimisation is in the hotlines and support forums and in the recovery programs. Furthermore, if your readers want to learn more information about cybersecurity and how VPN contributes to it then linking back to VPNSuggest.com will do the job.

1. Hotlines and Reporting Agencies

After being cheated, it is important to make a report to the proper law enforcement agencies. Here therein are significant hotlines and reporting platforms that can assist you through the recovery process and even in recovery of lost funds.

Key Reporting Agencies:

- Federal Trade Commission (FTC):

- Website: FTC Complaint Assistant

- Hotline: 1-877-FTC-HELP (1-877-382-4357)

- The FTC is one of the primary U.S. agencies for reporting cyber fraud, identity theft, and online scams. They provide resources for victims and work with law enforcement to investigate cases.

- Internet Crime Complaint Center (IC3) (Run by the FBI):

- Website: IC3.gov

- Purpose: IC3 accepts online reports of cybercrime, such as phishing, identity theft, and other fraudulent activities. This is the go-to resource for more severe cases where legal action may be pursued.

- Local Law Enforcement:

- Victims of financial scams should also contact their local police department or cybercrime unit. Filing a police report is often necessary to provide documentation when working with banks or credit card companies for chargebacks or disputes.

- National Cyber Security Alliance:

- Website: StaySafeOnline.org

- Provides extensive cybersecurity education and resources to help individuals protect themselves and recover from cybercrime.

2. Support Forums and Online Communities

Most cybercrime victims are able to seek comfort and advice on where to get help from support groups found on the Internet. Such forums enable victims to speak out and seek information they need or discuss the incidence; they also inform their users about other tricks of the swindlers.

Top Online Support Forums:

- Scam Survivors:

- Website: ScamSurvivors.com

- It provides the arena for the victims to come out and share how they have been scams as well as have people console them. It also offers information on how to cover scams and seek justice.

- Fraud.org:

- Website: Fraud.org

- Fraud.org is funded by the National Consumers League and is a rich source of information on how to guard against scams as well as how to report them. They also have a useful service that gives information about fraudulent activities that people should look out for.

- Reddit: r/Scams:

- Website: reddit.com/r/scams

- This freaking subreddit is basically a crowd-sourced support group where people come to share their tales of being scammed. This includes informative articles, advice, and the latest in Scam Alerts.

Why Support Communities Help:

- Shared Experiences: Support from a community makes a victim feel they are not alone, they can empower each other because they understand the challenges they undergo.

- Real-Time Updates: Read more people actively share the latest information and experiences about scams when using forums and communities and become more prepared to identify a scam in the future.

3. Cybercrime Recovery Programs

Besides reporting cases or seeking assistance via online support groups, there are programs that work to assist cybercrime victims in taking back their money and personal online identities.

Popular Recovery Programs:

- Identity Theft Resource Center (ITRC):

- Website: IDTheftCenter.org

- Hotline: 1-888-400-5530

- The ITRC offers support and guidance to identity theft victims and offers to help in building a recovery strategy and offers free advice on credit report and personal data protection.

- Cyber Civil Rights Initiative:

- Website: Cyber Civil Rights

- This organisation is for people who have been harassed or stalked online and enables victims to sue and get their privacy back.

- FTC IdentityTheft.gov:

- Website: IdentityTheft.gov

- The FTC has official recovery program for ID theft victims where victims of identity theft can find the specific instructions on how to recover from identity theft.

4. Link Back to VPNSuggest.com for More Cybersecurity Guides

For more in-depth cybersecurity guides, tips on using VPNs, and how to protect your privacy online, encourage your readers to visit VPNSuggest.com. This is where they can find:

- Comprehensive VPN reviews to help them choose the best VPN for their needs.

- Step-by-step guides on setting up VPNs and other security measures.

- Educational articles about staying safe online, how VPNs work, and how they can prevent cybercrime.

Conclusion

Nowadays, everyone seems to become a target of cybercrime scams, So it is highly essential to know the right thing to do when you are a victim. Here’s a quick recap of the key points covered in this guide:

- Immediate Actions: If you think you have been defrauded immediately contact your bank or financial institution to block your accounts. Inform the authorities such as the FTC and IC3 to help begin to investigate the scam.

- Legal Options: Consult a cybercrime lawyer and to try to seek back your lost money, you may also claim it back through your credit card company through chargebacks.

- Using Technology: For employee’s safety and organization data privacy when using the internet, apply utilities like VPN. Blockchain analysis can be valuable if you fall victim of such scams; it simplifies the process through which stolen cryptocurrency is recovered.

- Preventing Future Scams: VPN, Other Things: Familiarize yourself with VPN tools, MFA and how to avoid the common phishing scams in the future.

- Support Resources: Turn to hotlines, forums, and recovery programs in order to get help and directions as for the further actions during this time.

Timely reactions after been defrauded is important. The earlier one acts, the higher the probability of regaining lost money and the overall injuries to financial stability.

Please note that awareness of such services is extremely important, especially in the era of widely manifested internet activity. Sign up for our weekly newsletter to get news, views, and helpful advice to safeguard your assets and build a secure online identity. With the help of effective cooperation, we will learn how to prevent becoming a victim of cybercriminals and make the Internet more secure for all users.

Thank you for reading, and don’t forget to explore more resources and guides on cybersecurity at VPNSuggest.com!

FAQs: Recovering Money from a Cyber Crime Scam

1. What should I do immediately after realizing I’ve been scammed?

In order to if the scam and prevent continued business dealings, contact your bank or payment processor immediately.

2. Can I recover money from a wire transfer or online payment?

Yes it is generally a bill amount or charged depending with the provider’s policies and the time that one reports it. Transactions done in so many banks can be reversed if reported on time.

3. Should I report the scam?

Of course, as it to the local authority and other organizations such as the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3).

4. How can I gather evidence of the scam?

Any letter, receipt or snapshot which relates to the scam must be preserved for investigations.

5. What if I provided personal information?

Keep watch on your accounts and think about putting a fraud alert on your credit report.

Loading newsletter form...